You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListHow Integrating Quickbooks with Your Back Office Can Save You Thousands

June 28 2017

If you've been paying attention to the back office tech space, you've probably noticed a lot of talk about Quickbooks integration, especially by solutions that serve small- and mid-sized brokerages. This market segment has been rolling out integrations with not just Quickbooks, but other popular accounting programs like Xero and Waveapp.

Why? Well, once integrated, transaction data can move seamlessly between your back office platform and your accounting software. That means automatically cutting commission checks upon the close of a transaction, and never risking missed payments (mandatory for retaining top talent!). Brokers can also create invoices, sales receipts, and generate checks and 1099s.

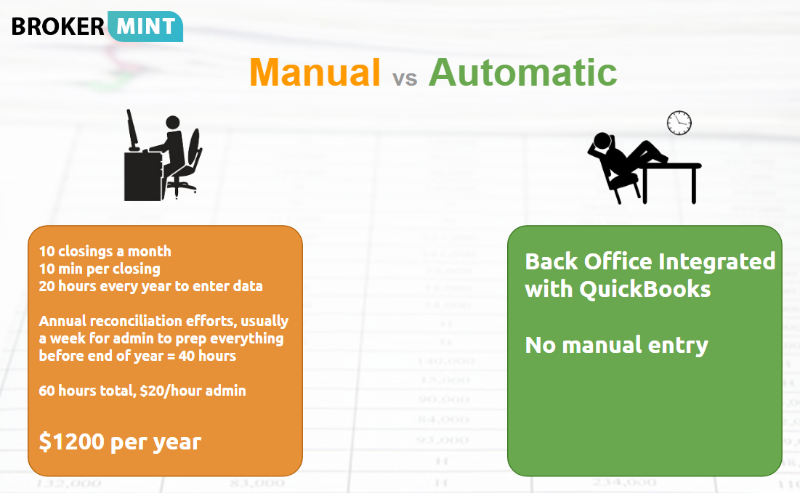

Integrating back office and financial systems can save even small brokers significant cash. Back office solution Brokermint estimates that brokers that close just 10 transactions per month can save at least $1200 per year with integration.

According to Brokermint co-founder Andrew Chishchevoy, Quickbooks is the integration their customers request most (they also integrate with several CRMs, Google, Dropbox, and more). "This integration means you do not need to copy and paste into your accounting software," he says. "It takes transaction information, including property address, information about your agents and vendors, as well as all financial numbers and populates that for you. If an agent doesn't exist in your accounting program, it will create that agent and then add all the needed information under that agent for you."

Solving Complex Problems

Chishchevoy notes that because different brokerages have different commission structures and workflows, every broker uses Quickbooks in a different manner. Any integration between your back office and financial systems needs to be flexible in order to accommodate a variety of workflows--the system should adapt to you, not you to it.

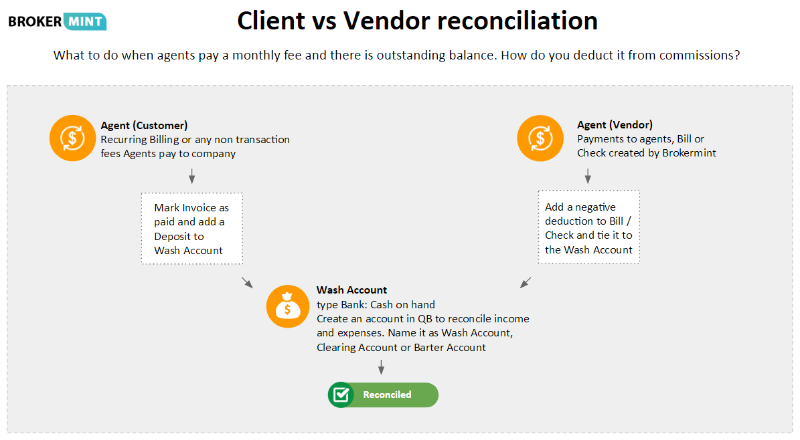

This flexibility means that brokers can set up easy fixes to complicated accounting issues. For example, say that agents at your company pay a monthly fee, but every month there's a handful of agents who don't pay it. How can you recoup that cost by deducting it from their next commission?

Chishchevoy suggests solving this problem by running a client versus vendor reconciliation, where the agent is set up as both your customer (the monthly fee) and a vendor (party owed payment via commission). Here's what that workflow looks like:

When complex solutions like this are automated, brokers save significantly on reconciliation time and revenue costs.

Brokers looking to save on an accounting/back office integration can sign up for a free 30-day trial of Brokermint. RE Technology members who want to continue using the program after trial are eligible for a 10% discount off subscription fees when they sign up at the link above.