You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListThe Big Lie: 'The House Is Not in a Flood Zone'

March 17 2021

We've ALL been here, right?!?

You find your clients their "Dream Home" and pull a flood zone report. You find that they are NOT in a flood zone, and you go ... "PHEW." Done.

One less hassle to contend with, one less issue to have to deal with in negotiations, securing a mortgage, and getting from contract to close. Check the box, and move on.

When flood insurance is so $#@!&^% confusing, why would you spend more time on it than you have to?

Yet, when your clients are committing much of their life savings to a 30-year investment, they want to feel confident they're doing everything they can to protect that investment. Following these three steps to simplify flood insurance places you in a position to confidently lead the conversation:

1. Reframe the Flood Question

As they say, "If it can rain, you have the potential of flood risk."

So, instead of asking a simple "Yes / No" question, reframe the question to "How much risk is your client willing to take on" to live in a specific property.

This opens up the dialogue. And in this super tight market, a world of possibilities.

Fact: Many flood policies are less than $600. For under $50 a month, your customer could secure peace of mind in case of a flooding event. Yet many REALTORS® avoid the topic, understandably. It's just one more unnecessary complication… right?

2. Understand the Basics of Flood Zones

As a REALTOR® it is increasingly important that you can "speak the language" of flood.

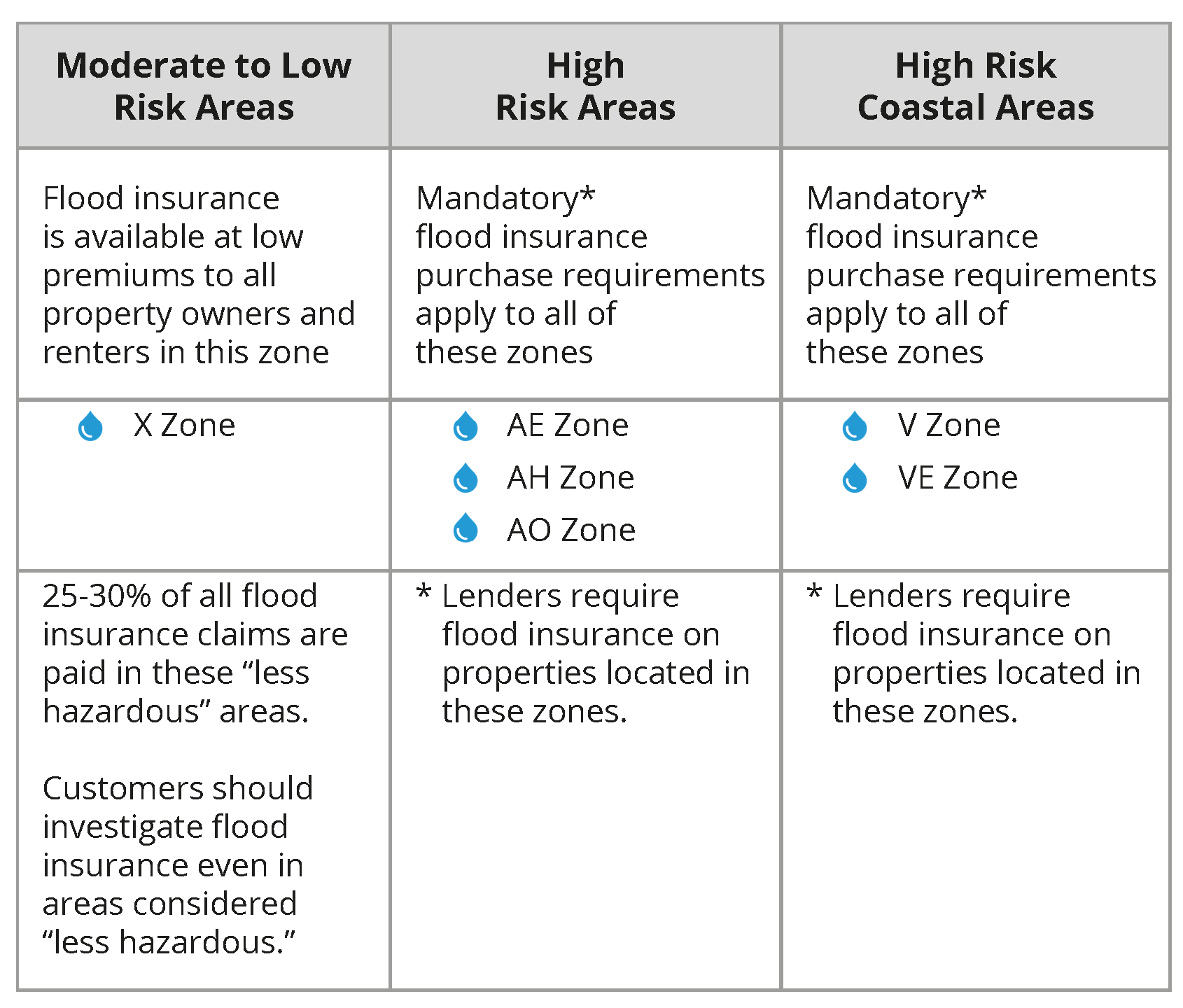

This chart simplifies many of the NFIP Flood Zones:

NFIP bases all of their pricing on these flood zone maps. Moreover, they take a blanketed view of flood risk, across entire communities.

What this means: two properties may be in X Flood Zones -- where there is low to medium risk -- yet one may have greater risk than the other, even if they are next to each other.

A key fact: a home may have a Zone X designation, but that does not guarantee it will never encounter a flood event. 25-30% of all flood insurance claims are paid in these "less hazardous" areas and that only reflects the homes that purchased flood insurance deemed "optional" by their lenders. Many more uninsured homes located in X zones experience damage from floods every year.

Knowing the flood zone for a property is an important piece of information, yet this is just a starting point for the discussion with your homebuying client. We're here to simplify the rest.

3. Create an Apples-to-Apples Total Cost of Ownership Comparison

There are currently two sources for flood insurance in the US, and BOTH need to be fully investigated for every property.

Unfortunately, these two sources are the no. 1 reason for most of the confusion for REALTORS® and their homebuying clients. They are:

- The National Flood Insurance Program, or NFIP, run by FEMA

- The emerging Private Flood Insurance market, offered by over 150 private insurance carriers

It is good practice to get both a NFIP and private insurance quote for each property your home buyer is seriously interested in, and include these quotes in an apples-to-apples comparison of total cost of ownership -- both at closing and over the lifetime of owning the property.

Since you have reframed the flood insurance conversation upfront, you now can confidently guide your buyer to an educated, well informed choice.

CartoFront provides free estimated flood insurance quotes as well as access to licensed insurance agents who can help with getting flood insurance in place. We're simplifying flood insurance -- equipping you with the tools you need, to help your customer make informed choices to properly protect their dream home.

If CartoFront is included in your MLS, simply click the raindrop in the listing icon bar to access this valuable service. If CartoFront is not yet included in your MLS and you are interested in learning how CartoFront can be added to your MLS for free, please contact [email protected].

Summary:

Flood is confusing, time-consuming, yet important to research. Three Steps:

- Reframe the Flood Question: What is a Property's Risk?

- Know the basics of FEMA's Flood Zones

- Include Flood Insurance Quotes in Total Cost of Ownership

If you are interested in learning more, access our free eBook: Everything You Always Wanted To Know About Flood Insurance* (*But Were Afraid To Ask)

If you are interested in learning more, access our free eBook: Everything You Always Wanted To Know About Flood Insurance* (*But Were Afraid To Ask)

CartoFront is a technology services company that is simplifying flood insurance for REALTORS®, their clients, and insurance agents.