You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListTurning Renters to Buyers: Dispelling 5 Key Myths

September 23 2021

More so than ever, misconceptions about the buying process keep renters from exploring the possibility of buying a home. Still, seasoned Realtors know that knowledge is power -- a gentle, educational nudge can go a long way in turning would-be renters into first-time homebuyers.

Many highly qualified renters see homeownership as out of reach, citing barriers like a minimum 20% down payment, economic uncertainty, or a shortage of inventory as barriers to entry. At the same time, historically low mortgage rates make buying a home more attractive than ever.

Renters need not sit on the sidelines and wait out today's uncertain housing market. Realtors can help them navigate the home buying process, establishing long-lasting relationships by pointing them to the right resources and helping them navigate both the decision to buy and a resale transaction.

Millennials Making the Move

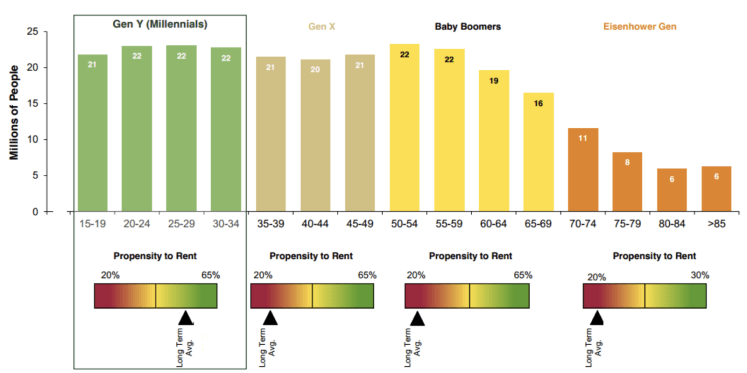

According to the Bureau of Labor Statistics and the U.S. Census Bureau, millennials have surpassed boomers as the largest segment of today's homebuyers.

Source: Bureau of Labor Statistics, U.S. Census Bureau, Green Street Advisors – Advisory & Consulting Group

At the same time, millennials represent roughly 65% of all renters. As the consumer segment hardest hit by macro-economic events, including the Great Recession and the global pandemic, Millennials had been significantly behind both baby boomers and Gen Xers in their rate of homeownership. However, Millennial earnings are on the rise. In a recent study, Harvard's Joint Center for Housing recorded a 157% increase in rental households making more than $150,000 per year, meaning more millennials are ready to buy homes today.

Three out of eight millennial renters believe they'll rent for life. Yet millennials are aware of the drawbacks of renting, including missed tax break opportunities, the inevitability of rent hikes, and the inability to build equity. As such, 62% of younger millennials and 68% of older millennials plan to buy within five years.

As a Realtor, you can help turn renters into home buyers by dispelling these five common myths:

Dispelling Five Common Myths Among Renters

1. "I done make enough money."

Income is necessary, but the amount of money someone earns plays a less significant role in getting a mortgage than many might think.

Lenders consider much more than just a paycheck when evaluating would-be homebuyers. Debt-to-Income (DTI) ratios and one's ability to make mortgage payments are more heavily considered than how much one makes. Lenders look at the whole picture, including credit scores and and the amount a borrower has for a down payment.

First-time homebuyers may need to pay down debt and organize their spending before entering the market. Realtors working in this segment take their time with these clients, placing them in rentals (and earning commissions) while helping them address these factors.

Additionally, rates for 30-year loans, 15-year loans, and 5-year ARMs are historically cheap, lowering the monthly cost of owning a home.

2. "I don't have enough for a down payment." / "I don't think I'll get approved."

Most renters believe you need 20% down to purchase a house. To buy a $300,000 home, you'd need $60,000 on hand—an overwhelming amount for most renters.

Many first-time buyers close on a house with almost nothing down.

The U.S. Department of Agriculture offers a 100% financing mortgage. The program, formerly known as a Section 502 mortgage, but more commonly referred to as a "Rural Housing Loan" or "USDA loan," is not just a rural loan—it's available to buyers in suburban neighborhoods, too. With a USDA loan, there's no down payment requirement, no maximum home purchase price, and eligible home repairs and improvements can be included Additionally, the upfront guarantee fee can be an add-on to the loan balance at closing.

FHA-insured loans allow for down payments as low as 3.5% in all U.S. markets and come with guidelines with a liberal approach to both down payments and credit scores. The FHA will insure home loans for borrowers with low credit scores, provided there is a reasonable explanation. Additionally, a down payment on an FHA-insured loan can come entirely from down payment assistance, including gifted funds.

Low-down payments are also available from Fannie Mae and Freddie Mac via the Conventional 97 program. Down payments are 3%, and it's less expensive for many buyers than an FHA-insured mortgage. Loans are currently capped at $548,250 and can only be used for fixed-rate mortgages on single-unit dwellings. In addition, the Conventional 97 program doesn't enforce a specific minimum credit score beyond those for a conventional home loan, and the entire 3% down payment can come from gifted funds from a spouse, partner, guardian, or family member.

The Veteran's Administration administers a no-money-down program available to members of the U.S. military and surviving spouses, with straightforward qualifications; and local municipalities often offer various levels of down payment assistance,

3. "There's nothing in my price range."

Once your rental client is pre-approved, they have a good sense of their target price range. However, in today's resale inventory-constrained environment, they often find themselves up against an increasingly competitive market.

Here's where Realtors can demonstrate their value. Experienced Realtors can leverage their hyper-local expertise to guide first-time homebuyers into neighborhoods with homes in their target range and find hidden gems—properties not quite move-in ready yet in a preferred neighborhood and within their client's price range.

4. "I might move in a few years."

Renting rather than buying is prudent over a short term—say a few months to a year, but it makes more sense to buy when staying for at least five years, and, in some cases, buying can even offer value when planning to stay for as few as two years.

It boils down to math. Renters considering buying should calculate how long they need to live in a purchased home before the cost of buying outweighs the costs of renting.

The New YorkTimes provides a Rent vs. Buy Calculator that takes the most important costs associated with buying a house, including mortgage details, growth rates, taxes, and closing costs, with computing equivalent monthly rents.

5. "I'll wait until I find the perfect house."

Renters new to the home buying market may have unrealistic expectations about the inevitable pros and cons proffered by every property. No resale home is perfect, and a first-time purchase will likely require a few concessions.

Good houses go fast! Renters looking to buy should be ready to act. Would-be buyers often need to make an offer right after a showing, so have reasonable criteria in mind beforehand.

Closing a deal will involve some trade-offs, but the accomplishment of homeownership almost certainly offset them.

More so than ever, there's value in working with renters, and while converting renters to buyers takes a little strategy and a lot of chutzpah, it's one of the most proven and cost-effective ways for Realtors to grow their book of business.

To view the original article, visit the Rental Beast blog.