You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListQuantifying The Value of Walkability and Public Transit

July 10 2013

Here at Walk Score we see the headlines that the housing market is recovering, interest rates are low and construction is on the rise, but still there is uncertainty in the macro dynamics of the real-estate market post 2007 real estate bubble.

In recent months, leading academics, consulting firms and real estate associations have touted the financial benefits of buying and living in walkable cities. While the Walk Score team prepares for Inman's Real Estate Connect conference this week, we wanted to share some recent research quantifying the financial value of walkability, access to public transit and shorter commutes.

The American Public Transportation Association, in partnership with the National Association of REALTORS®, recently published a study titled The New Real Estate Mantra that identified "a premium associated with walkability in the form of an increase in office, residential and retail rents, retail revenues, and for-sale residential values. The recession increased the premium for retail and office space in walkable urban neighborhoods; pre-recession (defined as 2000-07) there was ?a 23 percent premium per square foot valuation, during the recession (2008-10) it jumped to 44 percent."

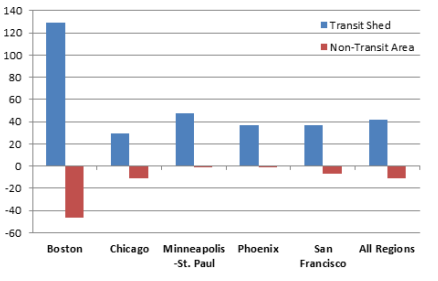

Percent change in average residential sales prices close to public transit vs. not close to public transit (2006-11). Source: American Public Transportation Association.

Using Walk Score data, the consulting firm Price Waterhouse Cooper and the Urban Land Institute published Emerging Trends in Real Estate 2013. This study shows that, while there are higher values in tier one walkable cities like San Francisco and New York, top "secondary locations... offering walkability and strong transit systems continue to outshine other cites" in terms of investment value when compared to areas with lower Walk Score ratings.

PWC and the Urban Land Institute summarize it simply: "Whatever way you look at it, tenants want to walk or be near public transit. Markets that offer both options will succeed."

Along similar lines, in a study conducted on behalf of Fannie Mae, Dr. Gary Pivo of the University of Arizona shows that "for every 5% increase in the percent of workers in a tract who walk to work, the risk of [loan] default decreases by 15%." Pivo goes on in his most recent report analyzing variables impacting loan defaults to show that "for every 10?minute increase in the mean commute time for residents in a census tract, the risk of default increases by 45%."

Read more about the financial value of neighborhood walkability and see how others are using Walk Score data for economic analysis.

To view the original article, visit the Walk Score blog.