You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListVacant "Zombie" Foreclosures Decrease 30 Percent in Second Quarter 2016 Compared to a Year Ago

May 19 2016

IRVINE, CA--(May 19, 2016) - RealtyTrac®, the nation's leading source for comprehensive housing data, today released its Q2 2016 U.S. Residential Property Vacancy and Zombie Foreclosure Report13, which shows nearly 1.4 million (1,398,046) U.S. residential properties (1 to 4 units) representing 1.6 percent of all residential properties were vacant as of May 2016, up 2.7 percent from the previous quarter when 1,361,628 U.S. residential properties were vacant.

The report also shows that 19,187 U.S. residential properties actively in the foreclosure process were vacant (zombie foreclosures), representing 4.7 percent of all residential properties in foreclosure -- down 3.1 percent from the previous month and down 30.1 percent from a year ago.

The analysis used RealtyTrac's publicly recorded real estate data -- including foreclosure status, and owner-occupancy status -- matched against monthly updated vacancy data from the U.S. Postal Service.

"Lenders have been taking advantage of the strong seller's market to dispose of lingering foreclosure inventory over the past year, evidenced by 12 consecutive months of increasing bank repossessions ending in February and now evidenced by these numbers showing a sharp drop in vacant zombie foreclosures compared to a year ago," said Daren Blomquist, senior vice president at RealtyTrac. "As these zombie foreclosures hit the market for sale they are providing a modicum of relief for the pressure cooker of escalating prices and deteriorating affordability that have defined the U.S. housing market in recent years."

Markets with the most zombie foreclosures

States with the most vacant "zombie" foreclosures were New Jersey (4,003), New York (3,352), Florida (2,467), Illinois (1,074), and Ohio (1,064).

"While overall foreclosure activity has declined from last year, we have experienced a slight increase in vacancies of residential properties facing foreclosure," said Michael Mahon, president at HER Realtors, covering the Cincinnati, Dayton and Columbus markets in Ohio. "As market supply and availability has remained low in many areas of the state, loan servicing companies have stepped up efforts of addressing homeowners delinquent on their mortgages, and have accelerated the process of filing for foreclosure. Feeling the pressure of loan servicers, many homeowners give up hope early, thus creating the vacancy event."

Among states with at least 100 zombie foreclosures, those with the highest zombie foreclosure rate (percentage of properties in foreclosure that are vacant) were Oregon (11.8 percent); Indiana (9.5 percent); Kentucky (8.0 percent); Maryland (7.2 percent); and Washington (6.6 percent).

"Thanks to the Seattle area's robust economy and strong housing market, the level of vacant properties has been growing smaller and smaller each month. So too has the level of zombie foreclosures which banks continue to release to the market," said Matthew Gardner, chief economist at Windermere Real Estate, covering the Seattle market, where the zombie foreclosure rate in Q2 2016 was 6.1 percent, down 3.8 percent from the previous quarter. "In its own small way, these zombie properties are actually helping to supplement the depleted inventory levels in Seattle. I expect this trend to continue as Seattle's foreclosure activity closes in on its long-term average."

Among metropolitan statistical areas with at least 100,000 residential properties, those with the most zombie foreclosures were New York (3,526); Philadelphia (1,744); Chicago (857); Miami (651); and Tampa (627).

Metro areas with at least 100 zombie foreclosures that posted the highest zombie foreclosure rate (percent of foreclosure properties that are vacant) were St. Louis, Missouri (10.6 percent); Indianapolis, Indiana (10.2 percent); Albany, New York (9.8 percent); Baltimore, Maryland (9.7 percent); and Portland, Oregon (9.7 percent).

Vacant bank-owned properties down 5 percent from previous quarter

A total of 43,602 U.S. bank-owned (REO) residential properties were vacant as of May 2016, representing 15.9 percent of all REO residential properties -- down 5.0 percent from the previous quarter when there were 45,897 vacant bank-owned properties.

States with the highest percentage of REO properties that were vacant were Oregon (29.8 percent); Indiana (29.7 percent); Delaware (28.3 percent); Michigan (27.0 percent); and Ohio (25.0 percent).

Among metropolitan statistical areas with at least 100,000 residential properties, those with the most vacant REOs were Detroit (3,982); Chicago (1,967); Miami (1,765); Atlanta (1,470); and Baltimore (1,434).

Metro areas with the highest REO vacancy rates (percentage of REOs that were vacant) were Flint, Michigan (44.7 percent); Akron, Ohio (37.6 percent); Cleveland, Ohio (33.8 percent); Peoria, Illinois (33.2 percent); and Fort Wayne, Indiana (33.1 percent).

Markets with highest vacancy rates

States with the highest vacancy rate overall (not just properties in foreclosure) were Michigan (3.4 percent), Indiana (3.1 percent), Mississippi (2.8 percent), Alabama (2.6 percent), and Oklahoma (2.6 percent).

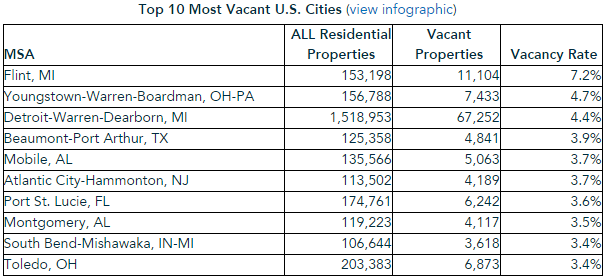

Among 146 metropolitan statistical areas with at least 100,000 residential properties, those with the highest vacancy rates were Flint, Michigan (7.2 percent); Youngstown, Ohio (4.7 percent); Detroit, Michigan (4.4 percent); Beaumont-Port Arthur, Texas (3.9 percent); and Mobile, Alabama (3.7 percent).

Markets with lowest vacancy rates

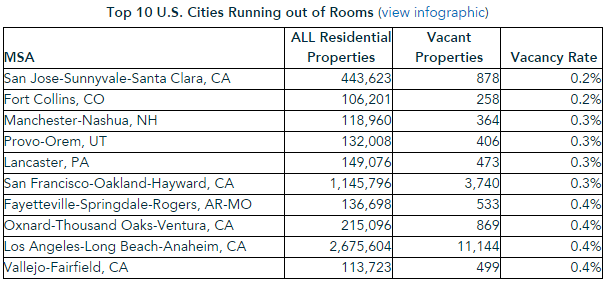

Metro areas with the lowest vacancy rates were San Jose, California (0.2 percent); Fort Collins, Colorado (0.2 percent); Manchester, New Hampshire (0.3 percent); Provo, Utah (0.3 percent); and Lancaster, Pennsylvania (0.3 percent).

Investment properties account for 75 percent of all vacant homes

A total of 1.1 million (1,055,725) U.S. residential investment properties were vacant as of May 2016, 75 percent of the all vacant properties nationwide and representing 4.4 percent of all investment properties.

States with the highest residential investment property vacancy rate were Michigan (11.0 percent); Indiana (10.3 percent); Alabama (7.1 percent); Ohio (6.8 percent); and Mississippi (6.7 percent).

Metro areas with the highest residential investment property vacancy rate were Flint, Michigan (27.6 percent); Detroit (13.5 percent); South Bend, Indiana (12.8 percent); Youngstown, Ohio (12.5 percent); and Fort Wayne, Indiana (12.0 percent).

Methodology

RealtyTrac matched its address-level property data for nearly 85 million U.S. residential properties -- including foreclosure status, owner-occupancy status, and equity -- against monthly updated data from the U.S. Postal Service indicating whether a property had been flagged as vacant by the postal carrier. Only metropolitan statistical areas with at least 100,000 residential properties were included in the rankings.

About RealtyTrac

RealtyTrac collects and licenses multi-sourced public record real estate data -- including tax, deed, mortgage, foreclosure, and proprietary neighborhood and parcel-level risk -- for more than 150 million U.S. properties, providing access to that data for businesses, consumers, policy makers and the media in a variety of venues all designed to increase real estate transparency: RealtyTrac.com is a property search and research portal for foreclosures and other off-market properties; Homefacts.com is a neighborhood research portal providing hyperlocal risks and amenities; HomeDisclosure.com produces detailed property pre-diligence reports; and RealtyTrac Data Solutions delivers real estate data and analysis to businesses through bulk file licenses, APIs, trend reports, and customized marketing lists. RealtyTrac data is cited by thousands of media outlets each month, including frequent mentions on CBS Evening News, The Today Show, CNBC, CNN, FOX News, PBS NewsHour and in The New York Times, Wall Street Journal, Washington Post, and USA TODAY.