You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListU.S. Home Loan Originations Decrease 4 Percent in Q2 2016 Despite Rise in Purchase and HELOC Originations

September 04 2016

IRVINE, Calif. – Sept. 1, 2016 — ATTOM Data Solutions, the nation's leading source for comprehensive housing data and the new parent company of RealtyTrac, today released its Q2 2016 U.S. Residential Property Loan Origination Report, which shows nearly 1.9 million (1,868,187) loans were originated on U.S. residential properties (1 to 4 units) in the second quarter of 2016, up 26 percent from the a two-year low in the previous quarter quarter but down 4 percent from a year ago.

The loan origination report is derived from publicly recorded mortgages and deeds of trust collected by ATTOM Data Solutions in more than 950 counties accounting for more than 80 percent of the U.S. population.

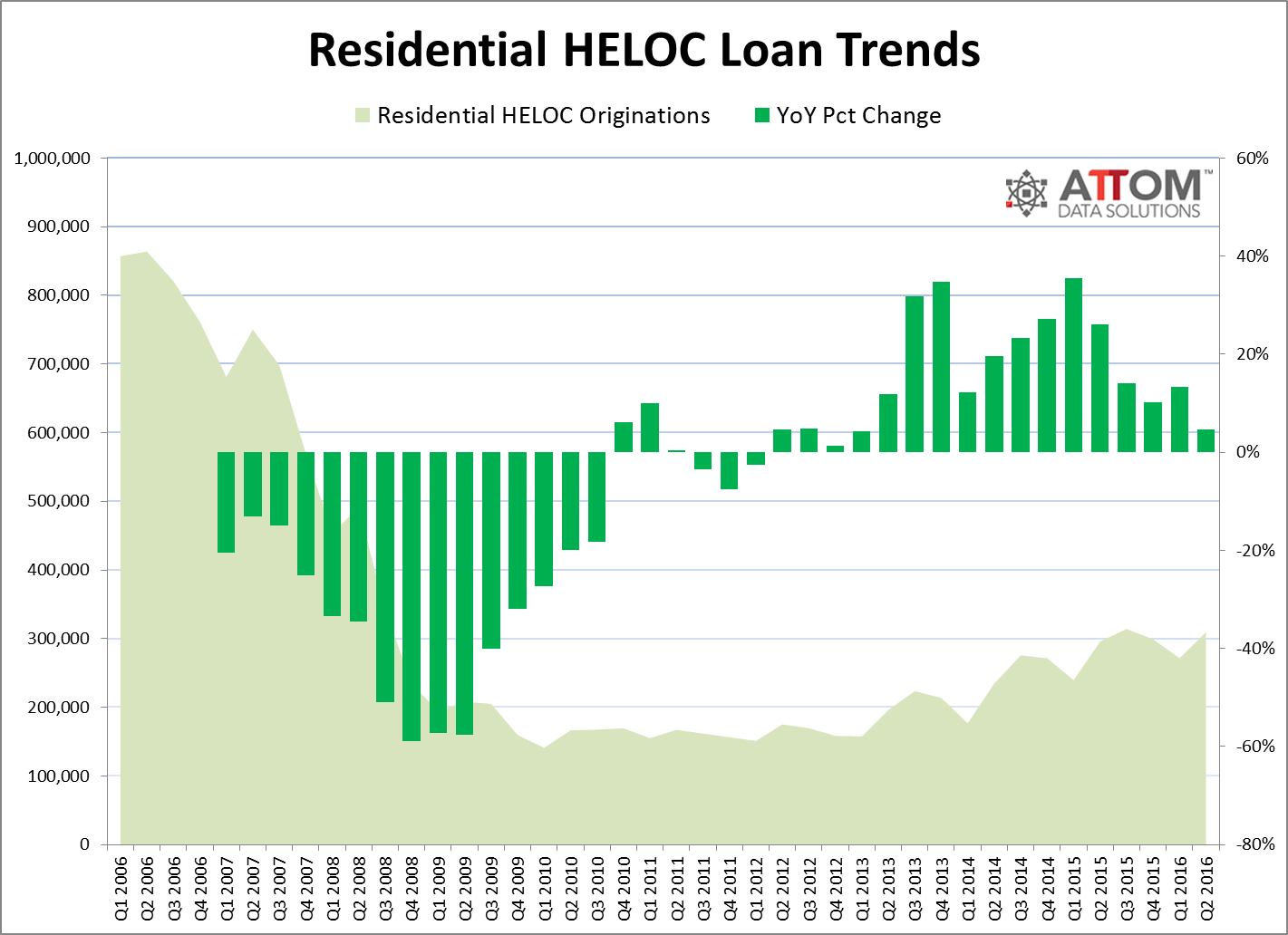

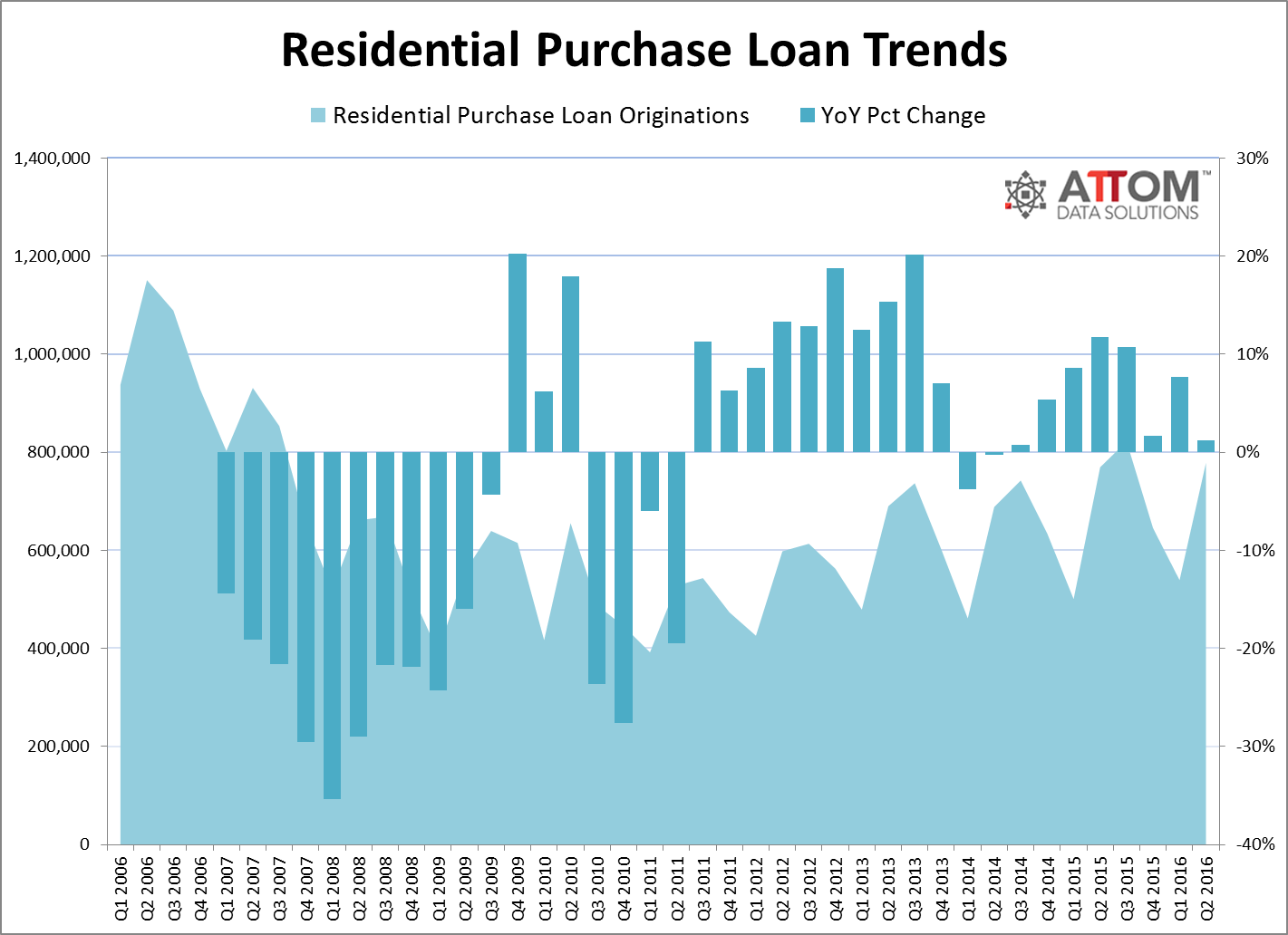

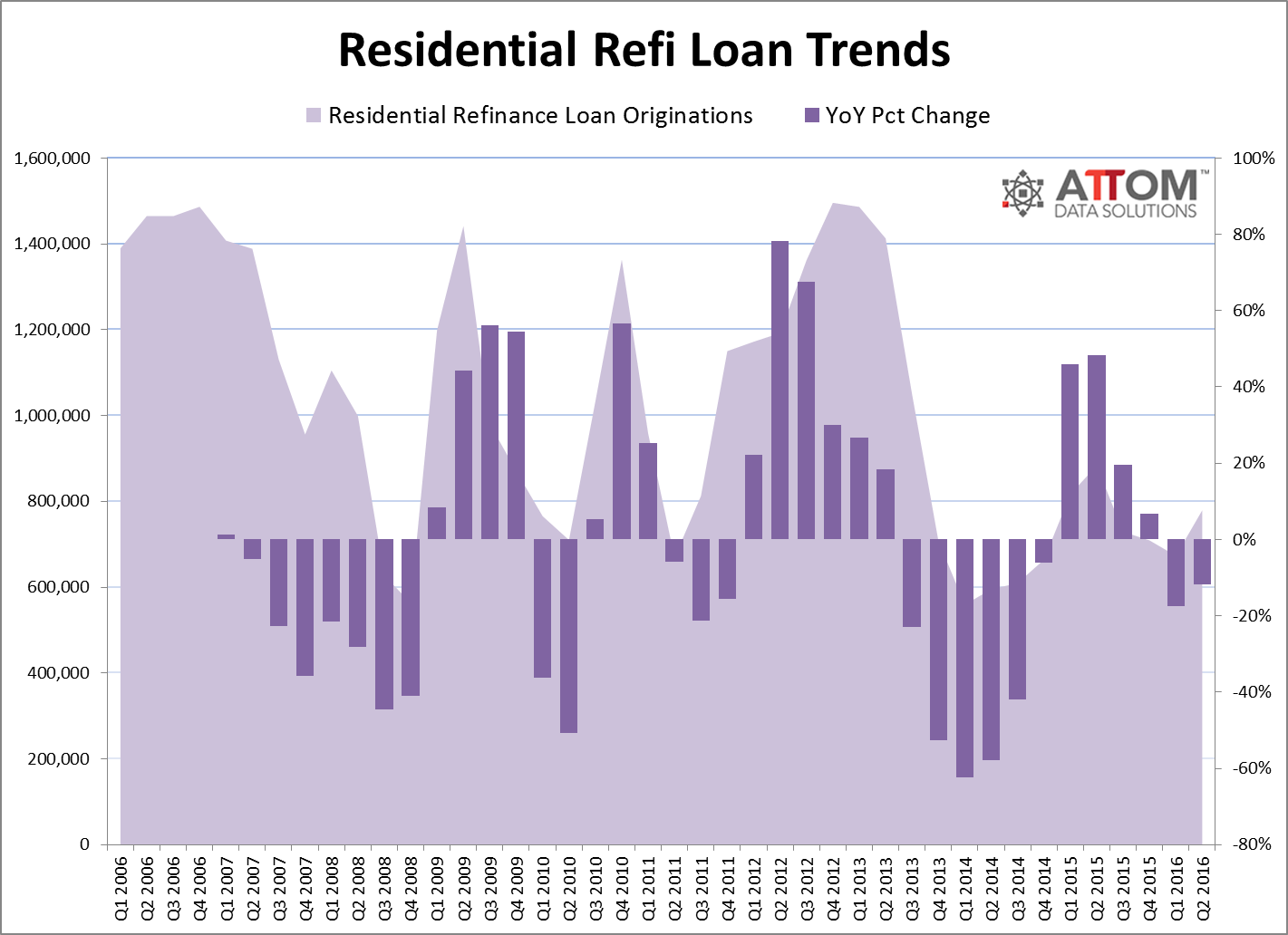

The 4 percent year-over-year decrease in total originations was driven by a 12 percent year-over-year decrease in refinance originations — the second consecutive quarter with an annual decrease. Conversely, purchase originations increased 1 percent from a year ago — the eighth consecutive quarter with an annual increase — and Home Equity Line of Credit (HELOC) originations increased 5 percent from a year ago — the 17th consecutive quarter with an annual increase.

"Homeowners are increasingly tapping the home equity that many have built up during the last four years of rapidly rising home prices," said Daren Blomquist, senior vice president at ATTOM Data Solutions. "Meanwhile those rapidly rising prices are also locking some non-cash buyers out of red-hot but high-priced markets, resulting in weaker purchase loan originations in places like Denver, San Francisco, Portland and Dallas. On the other hand, more affordable markets such as Cleveland, Kansas City and Boise are posting double-digit increases in purchase loan originations."

Dallas, Birmingham, Phoenix post biggest increases in HELOC originations

Among the 73 metropolitan statistical areas with a population of at least 500,000 and at least 5,000 total loan originations in Q2 2016, those with the biggest year-over-year increases in HELOC originations were Dallas (up 36 percent); Birmingham, Alabama (up 30 percent); Phoenix (up 28 percent); Sacramento (up 27 percent); and Seattle (up 25 percent).

"The combination of rapidly rising home prices and historically low interest rates has resulted in a substantial increase in the number of homeowners taking out a home equity line of credit (HELOC) in the greater Seattle area," said Matthew Gardner, chief economist atWindermere Real Estate, covering the Seattle market. "I believe the popularity of HELOCs compared to cash-out refinances is likely due to the fact that interest rates are traditionally lower for HELOCs. Additionally, if equity is withdrawn during a refinance, homeowners must begin paying back the funds immediately, whereas a HELOC allows you to use the funds as needed."

Other markets among the top 10 for biggest year-over-year increase in HELOC originations were and Columbus, Ohio (up 25 percent); Provo-Orem, Utah (up 24 percent); Denver (up 24 percent); Orlando (up 24 percent); and Cleveland, Ohio (up 23 percent).

"With an aging housing inventory across Ohio, we are seeing a resurgence of consumers electing to invest in their current homes, and utilize the increased availability of HELOCS for funding such needed repairs as new roofs, remodeling, and home addition projects," said Michael Mahon, president at HER Realtors, covering the Ohio housing markets of Dayton, Columbus and Cincinnati. HELOC originations increased 21 percent in Dayton and 17 percent in Cincinnati compared to a year ago.

"With our strong appreciation in South Florida over the past few years, many property owners are hedging their bets and locking in a low-rate HELOC that gives them flexibility and options in the coming years," said Mike Pappas, CEO and president at the Keyes Company, covering South Florida, where HELOC originations increased 19 percent in Q2 2016 compared to a year ago.

Cleveland, Kansas City, Boise post biggest increase in purchase originations

Among the 73 metro areas analyzed in the report, those with the biggest year-over-year increases in purchase loan originations in Q2 2016 were Cleveland, Ohio (up 31 percent); Kansas City (up 21 percent); Boise, Idaho (up 20 percent); Dayton, Ohio (up 17 percent); and Rochester, New York (up 15 percent).

Other markets among the top 10 for biggest year-over-year increases in purchase loan originations were Columbia, South Carolina (up 13 percent); Atlanta (up 13 percent); Milwaukee (up 12 percent); Deltona-Daytona Beach-Ormond Beach, Florida (up 11 percent); and Colorado Springs (up 11 percent).

Denver, Houston, San Francisco post decreases in purchase loan originations

Among the 73 metro areas analyzed in the report, those with the biggest year-over-year decreases in purchase loan originations in Q2 2016 were Honolulu, Hawaii (down 16 percent); Denver (down 8 percent); Louisville, Kentucky (down 7 percent); Houston (down 7 percent); and San Francisco (down 6 percent).

Other markets among the top 10 for biggest year-over-year declines in purchase loan originations were Bakersfield, California (down 6 percent); Portland (down 5 percent); Oxnard-Thousand Oaks-Ventura, California (down 5 percent); Dallas (down 5 percent); and Detroit (down 4 percent).

Philadelphia, Cincinnati, Madison post biggest declines in refi originations

Among the 73 metro areas analyzed in the report, those with the biggest year-over-year decreases in refinance loan originations were Philadelphia (down 26 percent); Cincinnati (down 25 percent); Madison, Wisconsin (down 24 percent); Baltimore (down 23 percent); and New York (down 23 percent).

Other markets among the top 10 for biggest year-over-year declines in refi originations were Louisville, Kentucky (down 20 percent); Washington, D.C. (down 20 percent); Allentown, Pennsylvania (down 19 percent); Chicago (down 18 percent); and Fresno, California (down 17 percent).

VA loan originations increase 14 percent to highest level in 10 years

A total of 136,248 loans backed by the U.S. Department of Veterans Affairs (VA) were originated in Q2 2016, up 35 percent from the previous quarter and up 14 percent from a year ago to the highest level for any quarter included in the scope of the report — going back to Q1 2006.

VA loans accounted for 8.7 percent of all purchase and refi originations in the second quarter, the highest share also going back to Q1 2006.

A total of 273,356 loans backed by the Federal Housing Administration (FHA) were originated in Q2 2016, up 29 percent from the previous quarter but down 17 percent from a year ago. FHA loans accounted for 17.5 percent of all purchase and refi loan originations in the second quarter, unchanged from the previous quarter but down from 19.9 percent in the second quarter of 2015.

A total of 11,377 residential construction loans were originated in Q2 2016, up 16 percent from the previous quarter and up 1 percent from a year ago. Construction loans — which are loans that finance improvements to real estate — accounted for less than 1 percent of all purchase and refi loan originations in the second quarter.

Report methodology

ATTOM Data Solutions analyzed recorded mortgage and deed of trust data for single family homes, condos, town homes and multi-family properties of two to four units for this report. Each recorded mortgage or deed of trust was counted as a separate loan origination. Dollar volume was calculated by multiplying the total number of loan originations by the average loan amount for those loan originations.

About ATTOM Data Solutions

ATTOM Data Solutions is the curator of the ATTOM Data Warehouse, a multi-sourced national property database that aggregates property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, health hazards, neighborhood characteristics and other property characteristic data for more than 150 million U.S. properties. The ATTOM Data Warehouse delivers actionable data to businesses, consumers, government agencies, universities, policymakers and the media in multiple ways, including bulk file licenses, APIs and customized reports.

ATTOM Data Solutions also powers consumer websites designed to promote real estate transparency: RealtyTrac.com is a property search and research portal for foreclosures and other off-market properties; Homefacts.com is a neighborhood research portal providing hyperlocal risks and amenities information; HomeDisclosure.com produces detailed property pre-diligence reports.