You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListMortgage Rates See Another Significant Decline

March 31 2017

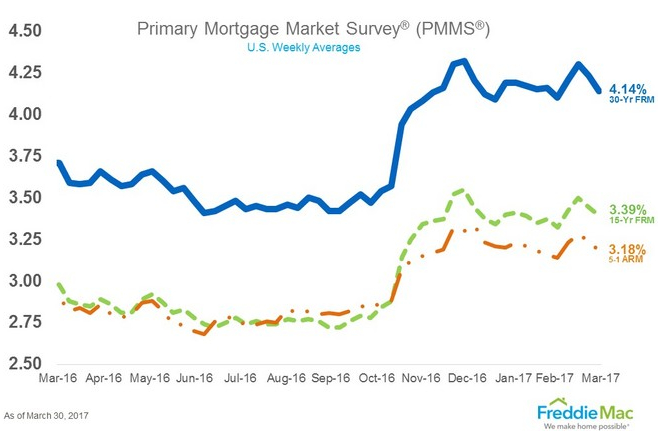

MCLEAN, VA--(Mar 30, 2017) - Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average mortgage rates dropping for the second consecutive week.

- 30-year fixed-rate mortgage (FRM) averaged 4.14 percent with an average 0.5 point for the week ending March 30, 2017, down from last week when it averaged 4.23 percent. A year ago at this time, the 30-year FRM averaged 3.71 percent.

- 15-year FRM this week averaged 3.39 percent with an average 0.4 point, down from last week when it averaged 3.44 percent. A year ago at this time, the 15-year FRM averaged 2.98 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.18 percent this week with an average 0.4 point, down from last week when it averaged 3.24 percent. A year ago, the 5-year ARM averaged 2.90 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

"The 10-year Treasury yield remained relatively flat this week," said Sean Becketti, chief economist, Freddie Mac. "The 30-year mortgage rate fell 9 basis points to 4.14 percent, another significant week-over-week decline. Despite recent mortgage rate fluctuation, new home sales far exceeded expectations in February and jumped 6.1 percent to an annualized rate of 592,000."

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we've made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders and taxpayers. Learn more at FreddieMac.com.