You are viewing our site as an Agent, Switch Your View:

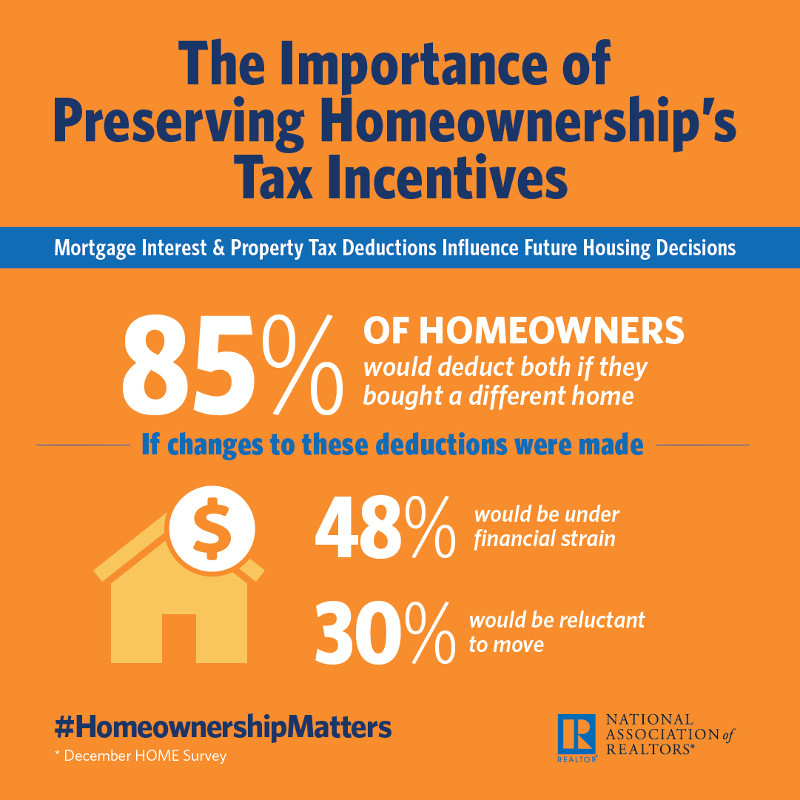

Agent | Broker Reset Filters to Default Back to List[Infographic] Homeowners Say Changing Homeownership's Tax Incentives Restricts Mobility, Causes Financial Strain

December 14 2017

WASHINGTON (December 12, 2017) – An overwhelming majority of homeowners would take advantage of the mortgage interest deduction and state and local property tax deductions if they were to purchase a new home, and a notable share said that the proposed changes to these tax incentives would affect their budget and desire to move in the future.

This is according to new data from the National Association of Realtors®' fourth quarter Housing Opportunities and Market Experience (HOME) survey. The findings clearly indicate that the proposed changes in the current House and Senate tax reform bills undercut the incentive of owning a home and would have a detrimental effect on many homeowners' financial situation and future desire to move:

- 85 percent would deduct both mortgage interest and property taxes if they bought a new home

If changes to these deductions were made:

- 48 percent would experience financial strain

- 30 percent would be reluctant to move

"Homeownership is an aspirational goal for millions of Americans, but getting there isn't always easy. Middle-class families count on tax incentives like the mortgage interest deduction and the state and local tax deduction to make homeownership a more affordable prospect," said NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty. "Realtors ® will continue to advocate for these and other important provisions as the tax reform debate continues."

The remaining findings from NAR's fourth quarter HOME survey will be released Monday, Dec.18.

The National Association of Realtors®, "The Voice for Real Estate," is America's largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.