You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListCoreLogic Reports August Home Prices Increased by 3.6% Year Over Year

October 02 2019

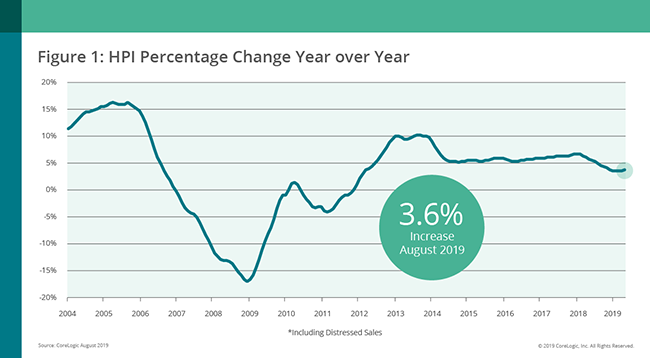

CoreLogic, a leading global property information, analytics and data-enabled solutions provider, today released the CoreLogic Home Price Index (HPI™) and HPI Forecast™ for August 2019, which shows home prices rose both year over year and month over month. Home prices increased nationally by 3.6% from August 2018. On a month-over-month basis, prices increased by 0.4% in August 2019. (July 2019 data was revised. Revisions with public records data are standard, and to ensure accuracy, CoreLogic incorporates the newly released public data to provide updated results each month.)

Home prices continue to increase on an annual basis with the CoreLogic HPI Forecast indicating annual price growth will increase 5.8% by August 2020. On a month-over-month basis, the forecast calls for home prices to increase by 0.3% from August 2019 to September 2019. The CoreLogic HPI Forecast is a projection of home prices calculated using the CoreLogic HPI and other economic variables. Values are derived from state-level forecasts by weighting indices according to the number of owner-occupied households for each state.

"The 3.6% increase in annual home price growth this August marked a big slowdown from a year earlier when the U.S. index was up 5.5%," said Dr. Frank Nothaft, chief economist at CoreLogic. "While the slowdown in appreciation occurred across the country at all price points, it was most pronounced at the lower end of the market. Prices for the lowest-priced homes increased by 5.5%, compared with August 2018, when prices increased by 8.4%. This moderation in home-price growth should be welcome news to entry-level buyers."

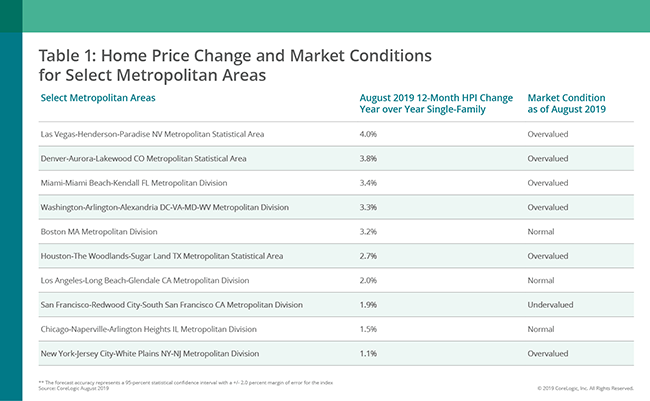

According to the CoreLogic Market Condition Indicators (MCI), an analysis of housing values in the country's 100 largest metropolitan areas based on housing stock, 37% of metropolitan areas have an overvalued housing market as of August 2019. The MCI analysis categorizes home prices in individual markets as undervalued, at value or overvalued, by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income. As of August 2019, 23% of the top 100 metropolitan areas were undervalued, and 40% were at value.

When looking at only the top 50 markets based on housing stock, 40% were overvalued, 16% were undervalued and 44% were at value. The MCI analysis defines an overvalued housing market as one in which home prices are at least 10% above the long-term, sustainable level. An undervalued housing market is one in which home prices are at least 10% below the sustainable level.

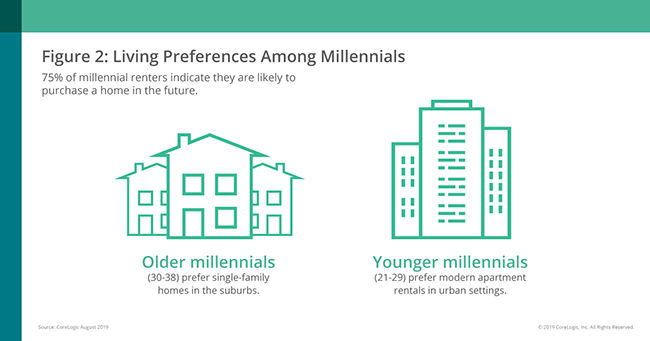

During the second quarter of 2019, CoreLogic, together with RTi Research of Norwalk, Connecticut, conducted an extensive survey measuring consumer-housing sentiment among millennials. The survey found that approximately 75% of millennial renters indicate they will likely purchase a home in the future. However, despite a desire from the entire millennial cohort to purchase a home, there is a clear difference between older and younger millennials' living situation preferences. Generally, older millennials (30-38) aspire to own a single, stand-alone home in the suburbs that is somewhat secluded. Meanwhile, younger millennials (21-29) lean towards modern apartment rentals in urban settings, with 55% of younger millennials saying they prefer to also live in lively neighborhoods. Still, 79% of younger millennials are confident that they will be homeowners in the future.

"The millennial cohort has now entered the housing market in force and is already driving major changes in buying and selling patterns. Almost half of the millennials over 30 years old have bought a house in the last three years. These folks are increasingly looking to move out of urban centers in favor of the suburbs, which offers more privacy and a greener environment," said Frank Martell, president and CEO, CoreLogic. "Perhaps most significantly, almost 80% of all millennials are confident they will become homeowners in the future."

The next CoreLogic HPI press release, featuring September 2019 data, will be issued on Tuesday, November 5, 2019 at 8:00 a.m. ET.

About the CoreLogic Consumer Housing Sentiment Study

In the second quarter of 2019, 877 renters and homeowners were surveyed by CoreLogic together with RTi Research. This study is a quarterly pulse of U.S. housing market dynamics. Each quarter, the research focuses on a different issue related to current housing topics. This first quarterly study concentrated on consumer sentiment within high-priced markets. The survey has a sampling error of +/- 3.1% at the total respondent level with a 95% confidence level.

About RTi Research

RTi Research is an innovative, global market research and brand strategy consultancy headquartered in Norwalk, CT. Founded in 1979, RTi has been consistently recognized by the American Marketing Association as one of the top 50 U.S. insights companies. The company serves a broad base of leading firms in Financial Services, Consumer Goods, and Pharmaceuticals as well as partnering with leading academic centers of excellence.

About CoreLogic

CoreLogic (NYSE: CLGX), the leading provider of property insights and solutions, promotes a healthy housing market and thriving communities. Through its enhanced property data solutions, services and technologies, CoreLogic enables real estate professionals, financial institutions, insurance carriers, government agencies and other housing market participants to help millions of people find, acquire and protect their homes. For more information, please visit www.corelogic.com.