You are viewing our site as an Agent, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListU.S. Foreclosure Activity in October 2019 Climbs Upward from Previous Month

November 17 2019

Completed Foreclosures (REOs) Reach Highest Point in 2019; Two Metro Areas in Illinois Now Rank Highest in Worst Foreclosure Rate; Foreclosure Starts Increase 17 Percent From Last Month

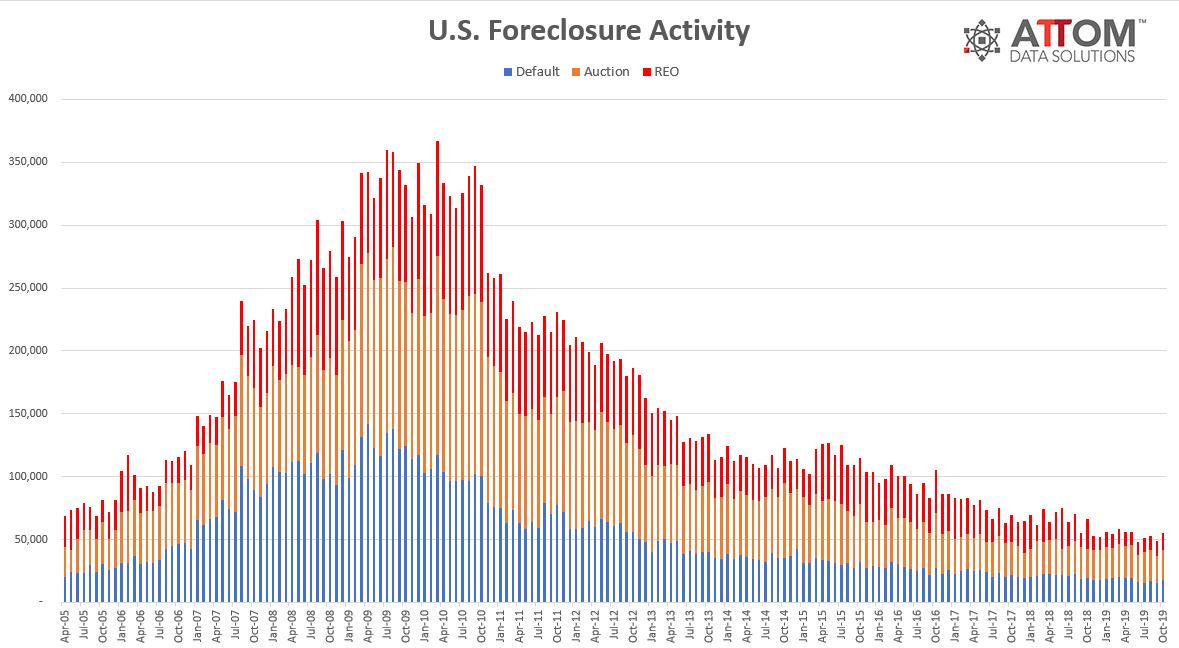

IRVINE, Calif. (Nov. 14, 2019) -- ATTOM Data Solutions, curator of the nation's premier property database and first property data provider of Data-as-a-Service (DaaS), today released its October 2019 U.S. Foreclosure Market Report, which shows there were a total of 55,197 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — in October 2019, up 13 percent from the previous month but down 17 percent from a year ago.

"While foreclosure activity across the United States rose in October, in looking at historical trends, October numbers tend to increase as lenders may be pushing filings through the pipeline before the holiday season," said Todd Teta, chief product officer with ATTOM Data Solutions. "The latest number is still below where it was a year ago and less than 15 percent of what it was during the depths of the Great Recession."

Foreclosure completion numbers climb in 2019

Lenders repossessed 13,484 U.S. properties through completed foreclosures (REOs) in October 2019, up 14 percent from last month, hitting the highest point in total number of completed foreclosures in 2019.

States that saw the greatest number in REOs in October 2019 included: Florida (1,493 REOs); Texas (912 REOs); Michigan (890 REOs); California (824 REOs); and Illinois (805 REOs).

Those major metropolitan statistical areas (MSAs) with a population greater than 200,000 that saw the greatest number of REOs included: Detroit, MI (705 REOs); New York, NY (684 REOs); Chicago, IL (679 REOs); Philadelphia, PA (470 REOs); and Atlanta, GA (430 REOs).

Highest foreclosure rates in New Jersey, Illinois and Maryland

Nationwide one in every 2,453 housing units had a foreclosure filing in October 2019. States with the highest foreclosure rates were New Jersey (one in every 1,316 housing units with a foreclosure filing); Illinois (one in every 1,336 housing units); Maryland (one in every 1,484 housing units); South Carolina (one in every 1,534 housing units); and Florida (one in every 1,571 housing units).

Among the 220 metropolitan statistical areas with a population of at least 200,000, those with the highest foreclosure rates in October were Peoria, IL (one in every 832 housing units); Rockford, IL (one in every 889 housing units); Atlantic City, NJ (one in every 933 housing units with a foreclosure filing); Fayetteville, NC (one in every 962 housing units); and Columbia, SC (one in every 1,028 housing units).

Foreclosure starts increase monthly in 36 states

Lenders started the foreclosure process on 28,667 U.S. properties in October 2019, up 17 percent from last month but down 1 percent from a year ago — the first double-digit month-over-month increase since February 2018.

States that saw a double digit increases from last month included: Arizona (up 52 percent); Ohio (up 52 percent); Florida (up 48 percent); New Jersey (up 47 percent); and California (up 36 percent).

Counter to the national trend, 13 states including Washington, DC posted month-over-month decreases in foreclosure starts in October 2019, including Maryland (down 42 percent); Idaho (down 36 percent); Delaware (down 32 percent); Nebraska (down 26 percent); and Utah (down 25 percent).

About ATTOM Data Solutions

ATTOM Data Solutions provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation's population. A rigorous data management process involving more than 20 steps validates, standardizes and enhances the data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 9TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, APIs, real estate market trends, marketing lists, match & append and introducing the first property data delivery solution, a cloud-based data platform that streamlines data management – Data-as-a-Service (DaaS).