You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListIn Most Major Markets, Negative Equity Has Fallen By Half Since Peak of Crisis

December 18 2014

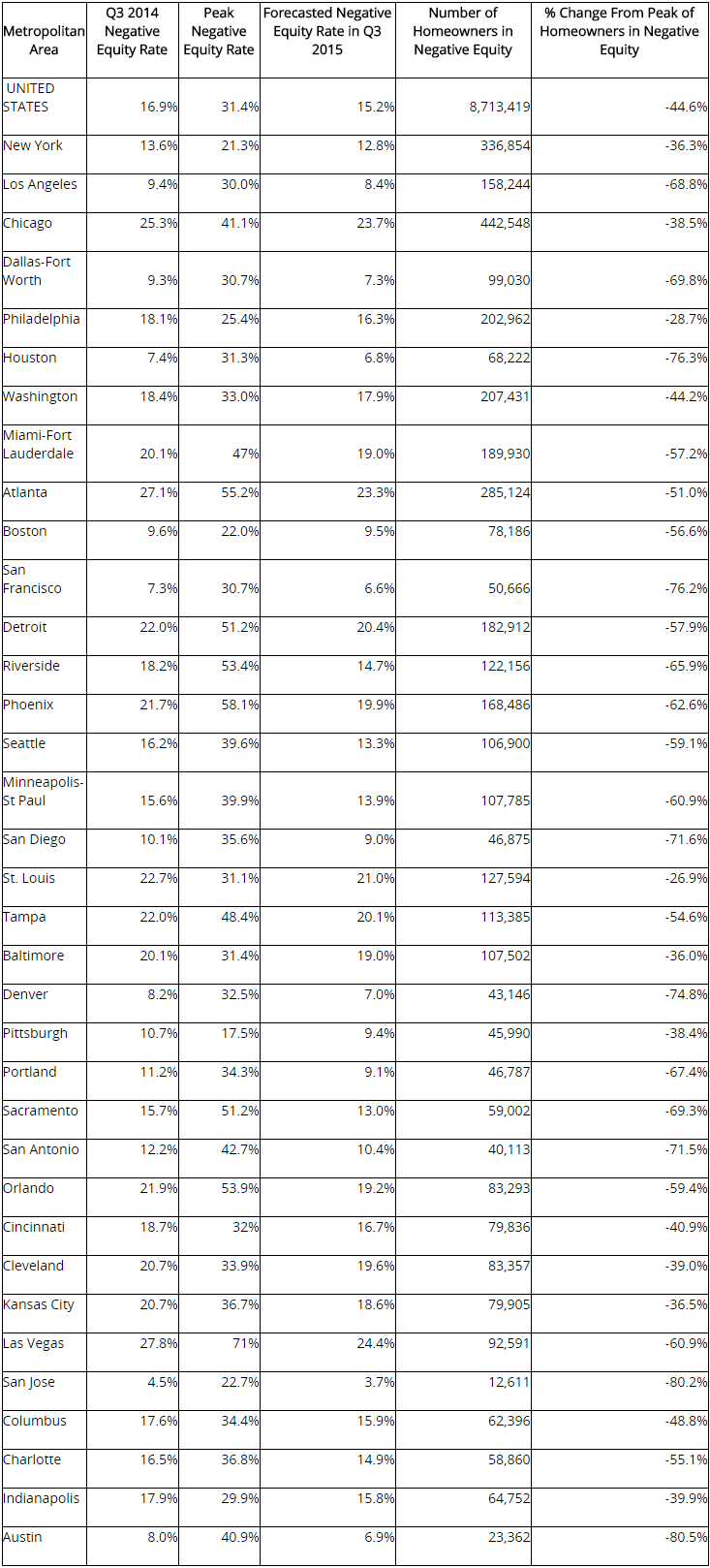

SEATTLE, Dec. 17, 2014 -- The number of U.S. homeowners upside down on their mortgages has fallen by more than 40 percent since early 2012, according to the third quarter Zillow® Negative Equity Reporti.

More than 7 million Americans who at one point owed more on their mortgages than their homes were worth have escaped -- either by paying down their mortgage balance, short sale and foreclosure or because their home values improved. Roughly 8.7 million homeowners remain trapped underwater on their mortgages, but the negative equity rate has halved since 2012 in the markets hit hardest by the recession.

Declining negative equity will have a ripple effect in the housing market, allowing previously stuck homeowners to list their homes for sale and adding to overall for-sale inventory just as millennial buyers are expected to begin to enter the market en masse in coming months and years.

This new inventory will also help slow home value appreciation, which has been fueled by high demand for homes and low supply.

The negative equity rate fell to 16.9 percent of all homeowners with a mortgage in the third quarter, down from 21 percent in the third quarter of 2013. It is expectedii to fall to 15.2 percent by the end of the third quarter of 2015.

The effective negative equity rate, including homeowners without enough equity to realistically afford the costs of selling and buying a new home, was 35 percent in the third quarter.

"The market has made terrific strides since bottoming out in late 2011 and early 2012, with millions of underwater homeowners freed in just the past few years, and millions more set to surface in coming months and years," said Zillow Chief Economist Dr. Stan Humphries. "Looking at negative equity helps us understand so many of the currently out-of-whack dynamics in the housing market, including low inventory, rapid home value appreciation and weak sales volumes. None of these problems will be solved overnight, in large part because negative equity will likely be a part of the housing market for years, and easily into the next decade in some hard-hit areas. But we're moving in the right direction, and time will heal all wounds."

Owners of less expensive homes were more likely to be underwater in the third quarter than owners of more expensive homes – in some cases, much more likely. In Detroit, for example, 49.2 percent of homes valued in the bottom price tieriii were underwater, while just 7.6 percent of the area's highest-priced homes were upside down. Similarly, in Chicago, 41.4 percent of bottom-tier homes were in negative equity, compared to 23.9 percent of middle-tier homes and 10.4 percent of top-tier homes.

Nationwide, 27.4 percent of bottom-tier homes were in negative equity in the third quarter, compared to 15.7 percent of middle-tier homes and 9.3 percent of top-tier homes.

About Zillow, Inc.

Zillow, Inc. operates the largest home-related marketplaces on mobile and the web, with a complementary portfolio of brands and products that help people find vital information about homes, and connect with the best local professionals. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow's Chief Economist Dr. Stan Humphries. Dr. Humphries and his team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Zillow also sponsors the bi-annual Zillow Housing Confidence Index (ZHCI) which measures consumer confidence in local housing markets, both currently and over time. The Zillow, Inc. portfolio includes Zillow.com®, Zillow Mobile, Zillow Mortgage , Zillow Rentals, Zillow Digs®, Postlets®, Diverse Solutions®, Mortech®, HotPads™, StreetEasy® and Retsly™. The company is headquartered in Seattle.