You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListMarketplace Networks in Real Estate

December 14 2018

Andrew Chen and Li Chen co-authored a fantastic piece entitled What's Next for Marketplace Startups? that details the ascent of platforms as a business model, starting with "unmanaged horizontal marketplaces" like Craigslist through the "Uber for X" era and into today's fully-fledged consumer platforms like Opendoor.

Below, I'll walk through a paraphrased analysis of their work and apply it specifically to the real estate industry to take a peek at what lies around the corner for brokers and home buyers/sellers.

The Birth of Software as a Service

The marketplace for goods has been well documented, thanks to the meteoric rise of tech giants like Amazon and eBay. The service economy, however, is still in relative infancy when it comes to reinvention through software. As the authors note, the service economy accounts for 69 percent of national consumer spending, of which an estimated 7 percent is done digitally.

How can we transform the way people use services like we have for holiday shopping? What does this look like in the real estate sector?

The Eras of Service Marketplaces

The Listing Era (1990s)

The genesis of platforms began in the 90s with sites like Yahoo, Craigslist, and Yelp that listed content and services (supply) that helped users find what they want (demand). As Chen notes, these were digitized versions of the Yellow Pages but with the onerous task on the user to search, contact, engage, coordinate, and transact.

Within the real estate sector, the most obvious entrants are within the marketplace: for-hire agents, attorneys, home-remodelers, painters, carpet cleaners, and other relevant services. A key hurdle is that fact that once there's a match, the remainder of the transaction happens off the platform.

This still plagues many real estate tools that exist today, namely poorly designed broker websites and CRMs that are not integrated or client-facing. Many MLS-provided search tools, for example, are only broker facing.

The Unbundled Craigslist Era (2000s)

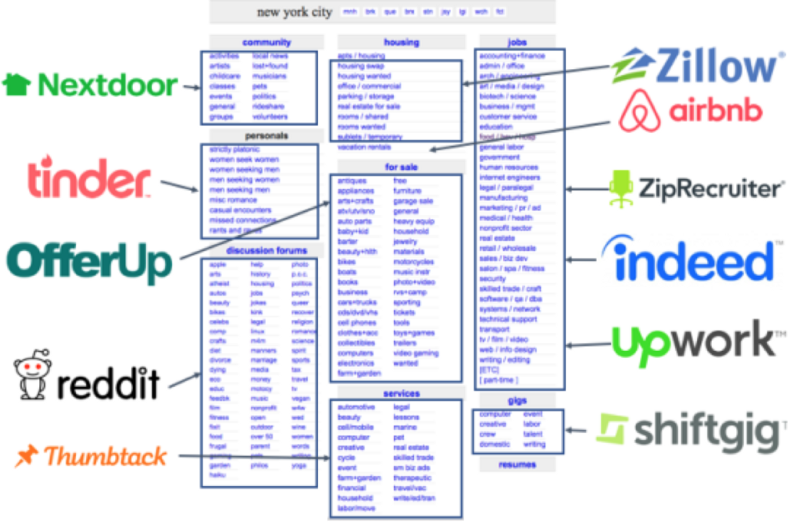

The next development was carving our specific horizontals and going deeper into the transaction, with an added emphasis on user experience. The below graphic, courtesy of Chen, visualizes this clearly:

The Craigslist Carve-Up [Source]

The value-add at this stages takes the form of deeper focus on a distinct transaction type and certifying the service providers. A hallmark of these platforms are network effects, which are derived when more value is created as more users join the platform. However, friction continues to be present as users need to contact the provider and transact offline; and this is after they've sifted through user reviews and filtering that has yet to benefit from advanced machine learning and matching algorithms.

Where is this most common in real estate? NextDoor and Zillow. The latter here more-so relates to the engagement with the listing or Premier Agent than home searching. Even listing agents who see their listing performance on Zillow are not able to easily connect with a buyer or buyer's agent on the platform, and have to market the listing through separate channels.

This is where most real estate technologies exist today, with the exception of a few.

The 'Uber for X' Era (2009–2015)

No pun intended, this model went from zero to 60 in seemingly no time at all. It's almost impossible to watch an episode of Shark Tank without hearing some semblance of, "We're Uber for ______" these days.

Leading with mobile, the on-demand marketplaces made it easier to hitch a ride, move your stuff, order delivery, and find a parking spot by connecting supply with demand in real time. This creates a seamless experience that features matching (Tinderizing may be another good term here), automating and optimizing pricing, and establishing trust through crowdsourced reviews and transparency.

Notably, these marketplaces tend to serve high-frequency, low-risk transactions, as opposed to that of buying or selling a home.

The Managed Marketplace Era (mid-2010s)

Real estate is a service industry. When transactions involve complex negotiations and costly mistakes, professionals remain a required focal point. As Chen puts it, "managed marketplaces take on additional work of actually influencing or managing the service experience, and in doing so, create a step-function improvement in customer experience."

The leap here is that the model does the heavy lifting as a full-stack, end-to-end platform, and in many cases (appear to) disrupt the industry norm. Opendoor is a great example of this, for metaphorically providing liquidity as a marketplace model by creating an end-to-end transaction platform, and also inventing an alternative buyer of homes, replacing the role of several within the value chain with a single entity.

Let's dive deeper into real estate within this model and see how this is playing out.

A Look Ahead: Marketplace Networks

At Homebloq, we consider our business model to be that of a marketplace network, where we enable connections between leads, clients, and agents as well as agents to agents.

A key theme is retaining the agent as a critical component, but moving tools that today exist separately onto a single platform. For example, listing agents can connect with a buyer's agent when the latter's client favorite a property or a home buyer can connect with an agent through our matching platform and move seamlessly into an MLS-powered and collaborative search tool.

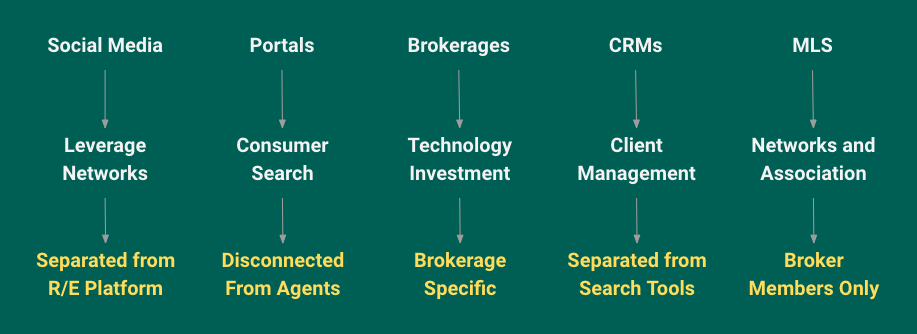

Existing tools such as Homelight and Radius Agent leverage much of the marketplace network benefits but fail as a full-stack offering in this sense. Beyond the obvious, what are some incumbents lacking when it comes to unlocking the power of platforms? Chen informs us on a few:

- Make discovery of licensed providers easier: HomeLight does this extremely well, quantifying "quality" to rank agents and recommending them to buyers based on matched preferences like home type, location, budget, and timing, among others.

- Utilizing unlicensed supply: This is a key to car-sharing companies like GetAround that monetize your car when you're not using it. For Sale By Owner technology could similarly do this by easing the process for home sellers who do not want to use an agent.

- Automation and AI: What technology blog post these days is not complete without mentioning machine learning? Matching algorithms, offer and negotiation automation, chatbots — the endless possibilities that exist in nearly all sectors.

How Full to Stack?

Looking across the real estate technology landscape, most of the tools available are linear, pipeline, or single feature types. How many tools are Realtors using to close a single transaction?

Separate tools leads to gaps in engagement with leads and clients. Example: offering poor client-facing search tools forces clients to revert to portals, leaving agents in the dark.

A common refrain we've heard as technologists in this space is, "I wish there was one tool to do it all!" We believe this is the next phase of technology development in real estate, and one that focuses less on the agent experience and more on that of the consumer. These are tall orders, but we feel that startups are better prepared to tackle these challengers than industry companies like Keller Williams or Compass, who should not divert from their core business—providing exceptional service to those buying and selling homes.

To view the original article, visit the Homebloq blog.