You are viewing our site as a Broker, Switch Your View:

Agent | Broker Reset Filters to Default Back to ListSwing State Housing Scorecard: Who Wins the Presidential Election with Real Estate Voters?

November 01 2012

Guest contributor RealtyTrac says:

Much like any presidential election in recent memory, the 2012 contest boils down to a select group of swing states that could go either way based on myriad factors impacting the voters in those states.

One of those factors is the housing market, which although a taboo subject for the candidates in all three debates, nevertheless should be a key consideration for many voters, whether homeowners or not.

We wanted to know which way voters in the swing states would vote based solely on the state of the housing market — and ultimately which candidate would ultimately win the election under that real estate-centric scenario.

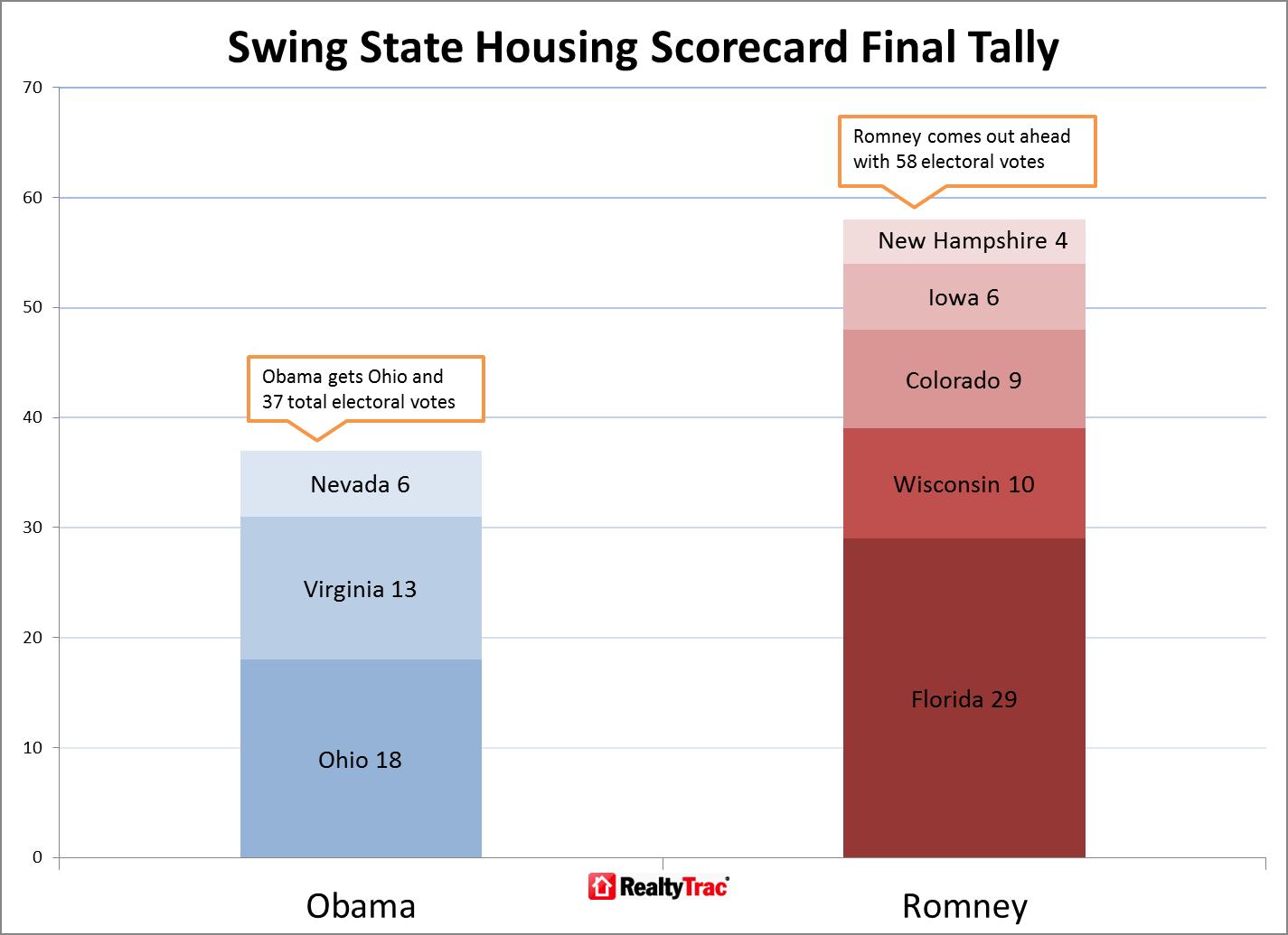

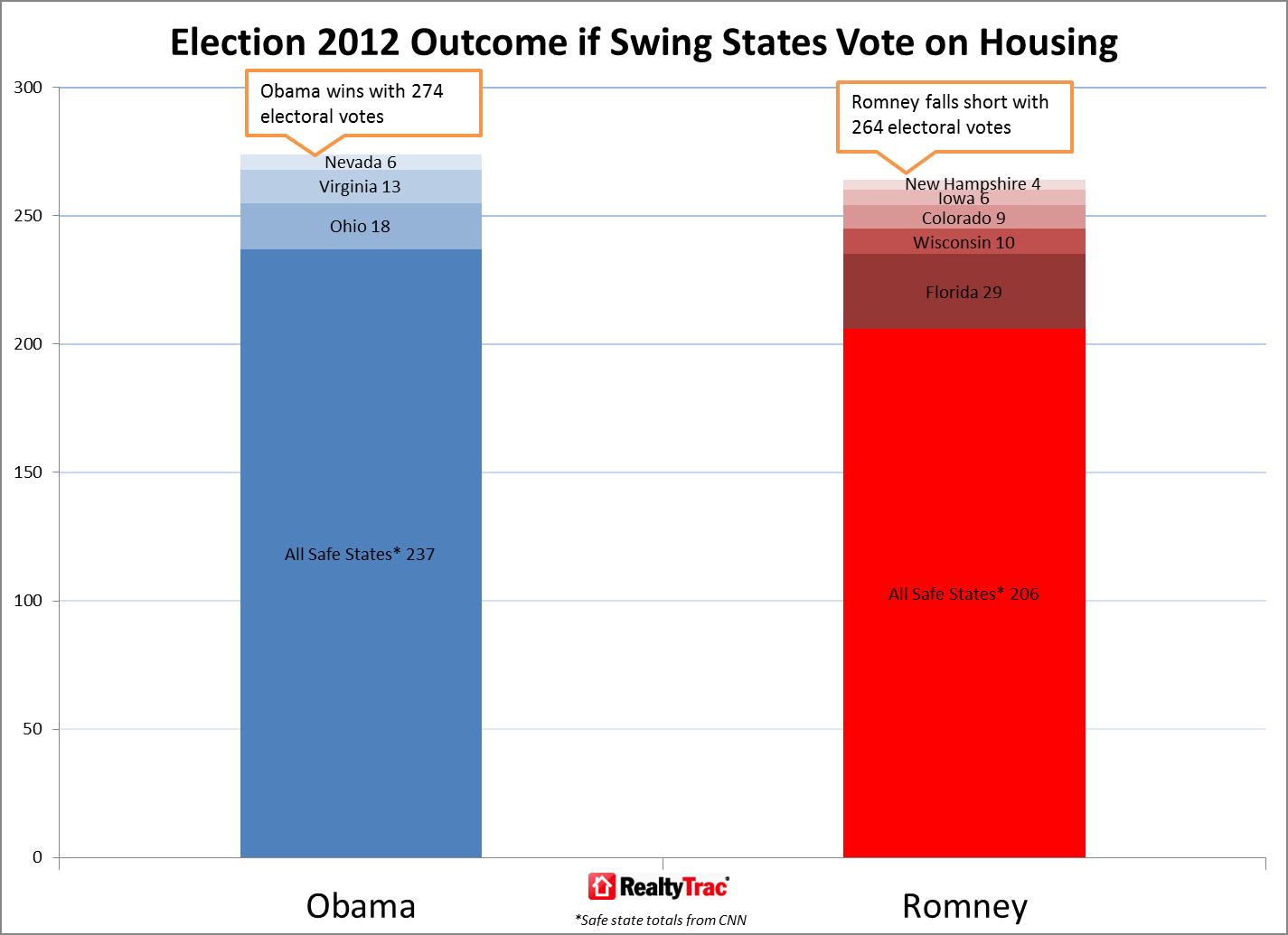

With that goal in mind, we took a closer look at five key housing market metrics in each of the eight swing states as identified by CNN and others. In a series of articles this week, we've awarded the electoral votes of each of these swing states to either Romney or Obama based on the admittedly not-iron-clad assumption that voters will pick Romney if the housing market in their state is worse off than four years ago (change is needed) and will pick Obama if the housing market is better off than four years ago.

The outcome was Romney winning the larger number of swing states and electoral votes in swing states, but Obama winning enough of the swing states to push him over the top to narrowly win the election by an electoral vote count of 274-264.

The five swing states were Colorado, Florida, Iowa, Nevada, New Hampshire, Ohio, Virginia and Wisconsin. The five metrics we analyzed were the following:

- Average home prices in July 2012 (most recent data available) compared to July 2012. Six of the swing states posted a decline in average home prices over the four-year period, but Iowa and Ohio bucked that trend.

- Unemployment rates in September 2012 compared to September 2008. Seven out of the eight states saw increases in their unemployment rates. The only exception was Ohio, where the unemployment rate of 7 percent in September 2012 was identical to the rate in September 2008.

- Foreclosure inventory in September 2012 compared to September 2008. Inventory was down in five of the states: Colorado, Nevada, New Hampshire, Ohio and Virginia. Foreclosure inventory was higher than four years ago in Florida, Iowa and Wisconsin.

- Foreclosure starts in September 2012 compared to September 2008. Foreclosure starts also were lower in five states compared to four years ago: Florida, Nevada, New Hampshire, Ohio and Virginia. But in Colorado, Iowa and Wisconsin foreclosure starts were higher.

- Distressed sale share in the second quarter of 2012 compared to the second quarter of 2008. Distressed sales accounted for a bigger percentage of all sales in four of the swing states: Florida, Iowa, New Hampshire, and Wisconsin. Distressed sales accounted for a smaller percentage of all sales in Colorado, Nevada, Ohio and Virginia.

To view the original article, visit the RealtyTrac website.